Insurance policies are contracts under which an insurance company agrees to pay the insured, or a third party on behalf of the insured, should certain contingencies arise.

No business is immune to loss resulting from ever-present risks. It is imperative, therefore, that a sound insurance program be designed and that it be kept up to date.

Because few businesses can afford the services of a full-time insurance executive, it is important that a competent agent or broker be selected to: (1) prepare a program that will provide complete coverage against the hazards peculiar to the construction business, as well as against the more common perils; (2) secure insurance contracts from qualified insurance companies; (3) advise about limits of protection; and (4) maintain records necessary to make continuity of protection certain. While an executive of the business should oversee insurance coverage, much of the detail can be eliminated by utilizing the services of a competent agent or broker.

It is necessary, of course, that the responsibility for providing protection be placed on an insurance company whose financial strength is beyond doubt.

Another important point for the buyer of insurance is the service that the company selected may be in a position to render. Frequently, construction operations are conducted at a considerable distance from city facilities. It is necessary that the company charged with the responsibility of protecting the construction operations be in a position to render on-the-job service from both a claim and an engineering standpoint.

The interests of contractors, subcontractors, and building owners are very closely allied. Particular attention should be given to the definition of these respective interests in all insurance policies. Where the insurable interest lies may depend upon the terms of the contract. Competent advice is frequently needed in order that all policies protect all interests as required.

While the forms of protection purchased and the adequacy of limits are of great importance to a prime or general contractor, it is also of great importance that the insurance carried by subcontractors be written at adequate limits and be broad enough to protect against conditions that might arise as a result of their acts. Also, the policies should include the interests of the prime or general contractor insofar as much interests should be protected.

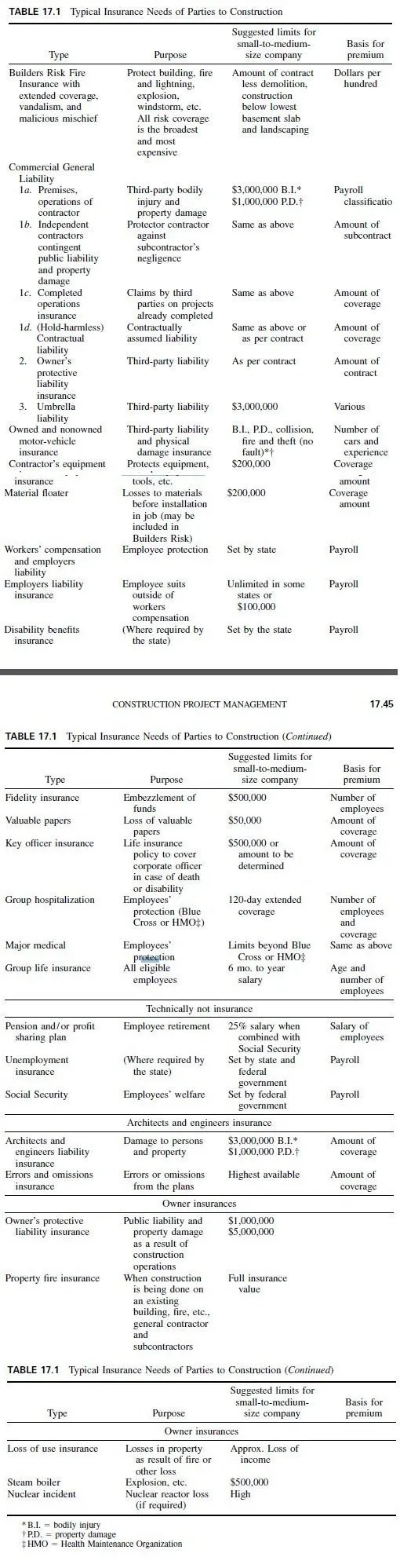

This section merely outlines those forms of insurance that may be considered fundamental (Table 17.1). It includes brief, but not complete, descriptions of coverages without which a contractor should not operate. It is not intended to take the place of the advice of experienced insurance personnel.

Fire Insurance

Fire insurance policies are well standardized. They insure buildings, contents, and materials on job sites against direct loss or damage by fire or lightning. They also include destruction that may be ordered by civil authorities to prevent advance of fire from neighboring property. Under such a policy, the fire insurance company agrees to pay for the direct loss or damage caused by fire or lightning and also to pay for removal of property from premises that may be damaged by fire.

Attention should be given to the computation of the amount of insurance to be applied to property exposed to loss. In addition, the cost of debris removal should be taken into consideration if the property could be subject to total loss. Under no circumstances will the amount paid ever exceed the amount stated in the policy. If the fire insurance policy has a coinsurance clause, the problem of valuation and adequate amount of insurance becomes even more important.

The form of fire insurance particularly applicable in the construction industry is known as Builders Risk Insurance. The purpose of this form is to insure an owner or contractor, as their interests may appear, against loss by fire while buildings are under construction. Such buildings may be insured under the Builders Risk form by the following methods:

1. The reporting form, under which values are reported monthly or as more buildings are started. Reports must be made regularly and accurately. If so, the form automatically covers increases in value.

2. The completed-value form under which insurance is written for the actual value of the building when it is completed. This is written at a reduced rate because it is recognized that the full amount of insurance is not at risk during the entire term of the policy. No reports are necessary in connection with this form.

3. Automatic Builders Risk Insurance, which insures the contractors interest automatically in new construction, pending issuance of separate policies for a period not exceeding 30 days. This form generally is used for contractors who are engaged in construction at a number of different locations.

There are certain hazards which, though not quite so common as fire and lightning, are nevertheless real. The contractor should insist that these be included in the insurance, by endorsement. A few of the available endorsements are:

1. Extended coverage endorsement, which insures the property for the same amount as the basic fire policy against loss or damage caused by windstorm, hail, explosion, riot, civil commotion, aircraft, vehicles, and smoke.

2. Vandalism and malicious mischief endorsement, which extends the protection of the policy to include loss caused by vandalism or malicious mischief. There is a special extended coverage form that provides coverage on an all-risk basis and includes the peril of collapse.

Completed-value and reporting forms treat foundations of a building in the course of construction as a part of the Builders Risk Value for insurance purposes.

But all work below the lowest basement slab, site work, and demolition are not covered by Builders Risk Insurance. The value of these items should be deducted from the amount of the policy. This will result in a saving of insurance premium.

Builders machinery and equipment should be specifically insured as a separate item if coverage is desired under the policy.

Under the terms of the AIA General Conditions, the owner is to provide the Builders Risk Insurance and pay for it. Under those circumstances, the contractor should request that the following clause appear as an endorsement to the policy:

Additional insureds under this policy: The Contractor and its Subcontractors, as their interests may lie.

This endorsement will assure the contractor and its subcontractors of a share in the insurance proceeds in case of claim. It further protects the contractor and subcontractors

from suit by the insurance company under its subrogation clause, should either of these parties have caused or contributed to the loss.